ماذا يحتوي حسابك التوفيري TFSA؟ اكتشف الأسرار مع مستشارك الشخصي!

It seems like you’ve shared a detailed excerpt from a blog post discussing Tax-Free Savings Accounts (TFSAs) in Canada, particularly highlighting the impressive values some Canadians have achieved within their TFSAs. The article references a Globe and Mail piece by Rob Carrick, which notes that 29 individuals have TFSAs worth $5 million or more, with another 323 having balances between $1 million and $4.99 million.

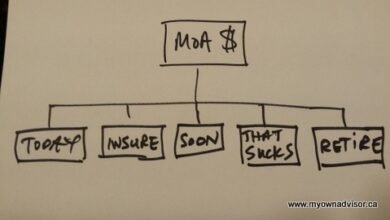

The author reflects on their own TFSA experience, emphasizing that while they haven’t reached those extraordinary heights, they’ve managed to grow their investments through careful planning and diversification. They mention using low-cost ETFs for broader market exposure and highlight the importance of balancing income needs with growth potential in their investment strategy.

The post also discusses the nature of investing success in TFSAs—pointing out that many high-value accounts may be attributed more to luck or timing rather than skillful investing alone. It provides realistic expectations for average returns based on historical performance within these accounts.

it encourages readers to consider what’s in their own TFSAs and how they can optimize them for future financial goals. If you have specific questions about this content or need further information on any aspect of TFSAs or investment strategies mentioned, feel free to ask!It seems you’ve shared a detailed article about Tax-Free Savings Accounts (TFSAs) in Canada, discussing their benefits, features, and investment strategies. Here’s a summary of the key points:

Overview of TFSAs

- Purpose: TFSAs allow Canadians to save money for various goals (e.g., house, wedding, retirement) while enjoying tax-free growth on investments.

- Contributions: Contributions are not tax-deductible but can be made throughout the year. Unused contribution room can be carried forward to future years.

- Withdrawals: Money withdrawn from a TFSA is tax-free and can be re-contributed in subsequent years.

Key Features

- Investment Flexibility: TFSAs are accounts that can hold various investments beyond just cash savings.

- No Spousal Accounts: Currently, there are no spousal TFSAs available.

- Contribution Limits: There are annual limits on contributions that do not depend on income levels. Over-contributing incurs penalties.

Investment Strategies

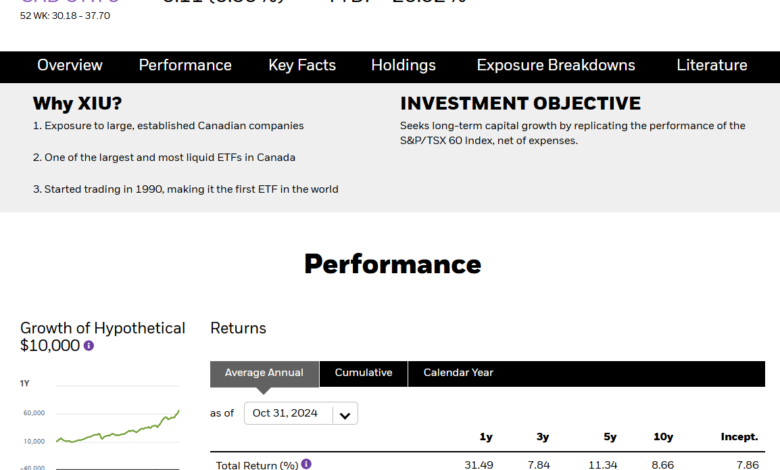

- Many Canadians use TFSAs for long-term growth through diversified portfolios including stocks or low-cost ETFs like XIU (iShares S&P/TSX 60 Index ETF).

- The article highlights the potential for significant gains through strategic investing but also warns about risks associated with individual stocks.

Performance Insights

- A recent report indicated some Canadians have amassed substantial wealth within their TFSAs due to successful investments in high-growth stocks like Tesla and Nvidia.

Conclusion

The author encourages all adult Canadians to take advantage of TFSAs as part of their financial strategy. They emphasize the importance of diversification and prudent investment choices over relying solely on luck or concentrated bets.

If you have specific questions or need further information about any aspect of this topic, feel free to ask!