قراءة نهاية الأسبوع: هل القوانين الجديدة للرهن العقاري مفيدة حقًا؟

It seems like you’ve shared a detailed excerpt from a blog post discussing various financial topics, including mortgage rules in Canada, market conditions, and investment strategies. Here’s a summary of the key points:

- Market Overview: The post reflects on the current state of the markets, noting that while they are up this year, there are rising unemployment rates and increasing debt burdens. It references comments from Federal Reserve Chair Jerome Powell about restoring price stability without causing significant unemployment.

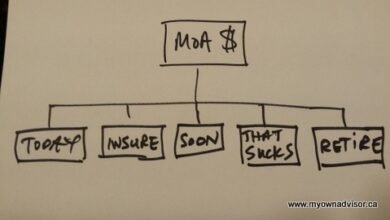

- Personal Finance Insights: The author shares insights on personal control over various aspects of life that can influence financial outcomes—such as effort, beliefs, actions, and the information consumed.

- Investment Portfolio: The author discusses their investment strategy involving equity ETFs (XAW for global exposure, QQQ for tech growth) and highlights their performance year-to-date.

- Mortgage Rule Changes: New Canadian mortgage rules allow 30-year amortization periods for first-time homebuyers and buyers of new builds to address housing affordability issues amid a housing shortage.

- Impacts of Mortgage Changes:

- For buyers: Extended amortization periods may reduce monthly payments but increase total interest paid over time.

– For lenders/banks: Increased risk management responsibilities as more high-value mortgages will be insured by government entities.

– For real estate markets: Anticipated increase in home sales could drive prices higher due to increased demand.

- Skepticism About New Rules: The author expresses skepticism about whether these new mortgage rules will genuinely help buyers or just benefit shareholders in Canadian banks.

- Additional Resources: Links to articles discussing intrinsic value in investing and capital gains tax implications are provided for further reading.

the piece combines personal finance advice with broader economic commentary while encouraging readers to consider how changes in policy might affect their financial decisions moving forward.It seems like you’ve shared a detailed excerpt from a blog post discussing various financial topics, including market conditions, mortgage rules, investment strategies, and the impact of tax changes on capital gains and dividends. Here’s a summary of the key points:

- Market Overview: The markets have seen significant gains this year despite rising unemployment and debt burdens. Both the Bank of Canada and the Federal Reserve are focused on restoring price stability without causing substantial job losses.

- Personal Control: A reflection on personal control emphasizes that individuals can manage their effort, beliefs, actions, attitude, integrity, thoughts, dietary choices, kindness towards others, reflectiveness, thoughtfulness in friendships and information consumption.

- Investment Strategy: The author shares their portfolio composition with equity ETFs such as XAW (All-World ex Canada), QQQ (Nasdaq-100), and HEQT (a global ETF). They highlight strong year-to-date performance for these investments.

- Dividend vs Capital Gains Taxation: There is discussion around how recent changes to capital gains tax may favor dividend income over capital gains for some investors.

- Housing Market Concerns: The CMHC estimates that Canada needs to build at least 3.5 million additional housing units by 2030 to restore affordability in housing markets.

- Mortgage Rules Discussion: New mortgage rules are debated regarding their effectiveness in addressing housing affordability issues compared to more fundamental shifts in housing policy focusing on supply rather than individual debt burdens.

- Investment Insights: Recommendations from industry experts about index funds for financial independence are mentioned alongside insights into intrinsic value investing strategies.

the piece encourages readers to consider both macroeconomic factors affecting investments as well as personal finance management principles while navigating current market conditions.The discussion around the new mortgage rules in Canada, particularly in high-cost cities like Toronto and Vancouver, raises several important points regarding their implications for buyers, lenders, and the real estate market as a whole.

Impacts for Buyers

- Extended Mortgage Terms: The ability to stretch mortgage payments over a longer period can make homeownership more accessible by lowering monthly payments. This could help manage cash flow for many buyers.

- Insurance Cap Changes: With the new cap on insured mortgages allowing homes valued between $1 million and $1.5 million to require less than a 20% down payment, this could open doors for more first-time buyers who may not have substantial savings.

- Investor Behavior: While it’s uncertain how these changes will affect real estate investors significantly, there is potential that some might leverage existing equity to acquire additional properties.

Impacts for Lenders/Banks

- The shift in risk management means that lenders may see reduced credit risks due to government-backed insurance on higher-value mortgages. This could potentially lead to increased profitability or stability within Canadian banks.

Impacts on Real Estate Market

- An increase in home sales is anticipated as these changes lower barriers to entry into the housing market. However, this influx of demand could further drive up prices in an already competitive market where supply is limited.

Critical Perspective

The author expresses skepticism about whether these mortgage rule changes genuinely benefit average Canadians or simply serve financial institutions’ interests better. They argue that instead of focusing solely on adjusting mortgage rules—which may encourage more debt—the government should prioritize increasing housing supply through sustainable development practices and building denser living spaces rather than sprawling suburban developments.

while the new mortgage rules aim to make homeownership more attainable amidst rising property values and interest rates expected to decrease by 2025, they also raise concerns about long-term debt sustainability and whether they adequately address underlying issues related to housing supply shortages in major urban centers.