التوقيت المثالي لمدفوعات CPP وOAS: دليل شامل لتحقيق أقصى استفادة!

work or a rental property, your RRIF and LIF income will play a more vital role in your retirement years. In this scenario, it is advisable to balance using your RRIF and LIF income alongside your CPP and OAS payments to cover living expenses. Keep in mind that all of these payments will be taxed as income.

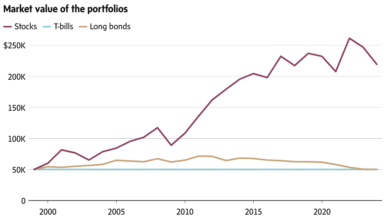

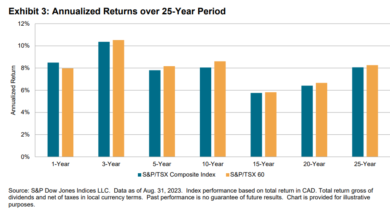

By delaying your CPP and OAS payments by one full year, you can increase future CPP payments by 8.4% (after age 65) and OAS payments by 7.2%. This can be viewed similarly to a return on an investment portfolio. By comparing the increases in CPP and OAS with the potential growth of funds inside your RRIF or LIF, you can determine whether it makes sense to withdraw from those accounts sooner or take the benefits earlier while allowing the RRIF/LIF accounts to grow.

Final Words

When making financial decisions regarding retirement benefits like CPP and OAS, it’s crucial to consider your unique circumstances. The strategies discussed—continuing work, liquidating investment accounts before age 70, or balancing withdrawals—can help guide you toward making informed choices that align with both current needs and future financial security.

Ultimately, consulting with a financial advisor may also provide personalized insights tailored specifically for you based on comprehensive analysis of all factors involved in planning for retirement effectively.It seems you’ve shared a detailed article discussing retirement planning, particularly focusing on the Old Age Security (OAS) and Canada Pension Plan (CPP) benefits, as well as strategies for managing income during retirement. Here’s a summary of the key points:

Key Points on Retirement Income Planning

- Income Thresholds:

– If your total income exceeds $90,997 in 2024, you may have to repay part or all of your OAS payment.

- Assessing Your Work Status:

– Determine if you are still working full-time or part-time.

– If working part-time and needing additional funds, consider withdrawing from CPP or OAS to supplement your income.

- Investment Accounts:

– Withdrawals from Tax-Free Savings Accounts (TFSA) or Non-Registered accounts do not count as taxable income.

– Withdrawals from Registered Retirement Savings Plans (RRSP), Registered Retirement Income Funds (RRIF), Locked-In Retirement Accounts (LIRA), and Life Income Funds (LIF) are taxed as income.

- Pension Plans and Rental Properties:

– Income from pension plans is taxable and counts towards the OAS clawback calculation.

– Receiving multiple sources of income can increase the risk of having OAS payments reduced.

Strategies for Managing CPP and OAS

- Keep Working Longer:

– Delaying CPP and OAS payments while continuing to work can be beneficial financially.

- Liquidate RRSP/RRIF Before Age 70:

- Consider converting RRSPs into RRIFs/LIFs before age 70 to withdraw funds early while delaying CPP/OAS until age 70 for higher future payouts.

- Balanced Approach:

– If you lack pension/rental property income, balance withdrawals from RRIF/LIF with CPP/OAS payments while being mindful that all will be taxed as income.

- Future Payment Increases:

- Delaying benefits by one year increases future payments significantly—8.4% for CPP after age 65 and 7.2% for OAS—similar to investment returns.

Final Thoughts

- Each individual’s financial situation is unique; therefore, it’s crucial to evaluate personal circumstances when making decisions about retirement funding strategies.

This summary encapsulates the essence of planning around retirement benefits in Canada while considering various sources of potential income during retirement years.

2 تعليقات