تحديث دخل الأرباح لشهر يوليو 2024: اكتشف الفرص الرابحة!

It looks like you’ve shared a detailed update on your dividend income for July 2024, along with insights into your investment strategy and portfolio management. Here’s a summary of the key points:

Summary of July 2024 Dividend Income Update

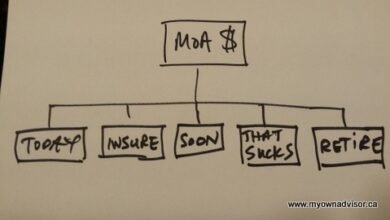

- Investment Strategy:

– The portfolio consists of a mix of Canadian and U.S. dividend-paying stocks, as well as low-cost equity ETFs.

– The focus is on generating income while also allowing for some growth.

- Recent Purchases:

– Additional shares of Tourmaline Oil (TOU) were purchased, with plans to buy more if the price remains under $60.

– Capital Power (CPX) has increased its annual dividend, contributing positively to projected annual dividend income.

- Projected Annual Dividend Income (PADI):

– The PADI continues to rise due to recent increases in dividends from various holdings.

– Current average monthly income is approximately $3,858, translating to about $127 per day.

- Future Plans:

– Minimal changes are expected in the portfolio moving forward; potential purchases include more TOU or other Canadian stocks in non-registered accounts and XAW or utility stocks in RRSPs.

- Performance Comparison:

– This month’s update shows an increase of over $4,000 compared to the same time last year.

- Philosophy on Investing:

- Emphasis on sticking with a plan and ignoring market noise.

– Acknowledgment that market conditions can be unpredictable but maintaining discipline is key.

- Engagement with Readers:

– Encouragement for readers to ask questions and engage through comments or emails regarding their own financial journeys.

This update serves not only as a personal reflection but also provides insights that may benefit others looking at similar investment strategies focused on dividends and long-term growth through careful stock selection and ETF investments.It looks like you’ve shared a detailed update on your dividend income for July 2024, along with insights into your investment strategy and portfolio adjustments. Here’s a summary of the key points:

Summary of July 2024 Dividend Income Update

- Recent Dividends Received:

– Key companies that paid dividends include Telus (T) and TD Bank (TD).

– Additional shares of Tourmaline Oil (TOU) were purchased, with plans to buy more if the price remains under $60.

- Dividend Increases:

– Capital Power (CPX) announced an annual dividend increase.

– Tourmaline Oil also provided a special dividend alongside an increase in their quarterly payout.

- Projected Annual Dividend Income:

– The projected annual dividend income continues to rise due to these increases.

- Current average monthly income is approximately $3,858, translating to about $127 per day or over $22 per hour if treated as a job.

- Investment Strategy Moving Forward:

- Limited changes are planned for the second half of 2024.

– For non-registered accounts: More TOU or other Canadian stocks focused on lower-yielding, higher-growth opportunities.

– For RRSPs: More XAW or Canadian utility stocks as interest rates decline.

- Year-over-Year Comparison:

– This month’s income is over $4,000 higher than in July 2023.

- General Reminder:

– The updates focus primarily on non-registered accounts and RRSPs; TFSAs and pensions are not included in this analysis.

- Engagement Invitation:

Readers are encouraged to ask questions regarding financial strategies or specific investments.

Conclusion

This update reflects a solid approach towards building passive income through dividends while maintaining flexibility in investment choices based on market conditions and personal financial goals. If you have any specific questions about this update or need further information on any aspect mentioned, feel free to ask!It looks like you’ve shared a detailed update on your dividend income for July 2024, along with insights into your investment strategy and portfolio management. Here are some key takeaways from your update:

- Investment Philosophy: You emphasize the importance of having a plan and sticking to it, which is crucial for successful DIY investing. This includes managing debt wisely and maintaining a healthy cash balance.

- Dividend Income Growth: Your projected annual dividend income (PADI) has increased significantly compared to last year, averaging about $3,858 per month or nearly $127 per day.

- Portfolio Composition: You maintain a mix of stocks and low-cost ETFs in your portfolio, with Telus (T), TD Bank (TD), and Tourmaline Oil (TOU) being notable holdings that contribute to your dividend income.

- Future Plans: Looking ahead, you plan to continue purchasing more shares of TOU or other Canadian stocks in non-registered accounts while considering additional investments in utility stocks within RRSPs as interest rates decline.

- Community Engagement: You appreciate feedback from readers and encourage questions about your investment approach.

- Performance Comparison: The current month’s income is over $4,000 higher than the same time last year, showcasing the effectiveness of your investment strategy over time.

Your approach reflects a disciplined method towards building wealth through dividends while adapting to market conditions as needed. If you have any specific questions or need further insights on any aspect of this update or investing strategies in general, feel free to ask!