Did you know that nearly half of all prospective home buyers in this country begin their search without a clear budget? This often leads to disappointment and wasted time. Getting your finances in order first is the smartest move you can make.

I’m here to guide you through the essential first step: obtaining a pre-approval. Think of it as your financial green light. This initial step in the home buying process gives you a powerful advantage.

It provides a clear spending limit and can lock in an interest rate, protecting you from market increases. While it’s not a final guarantee from a lender, it shows sellers you are a serious and qualified buyer. This strengthens your position when you find the perfect home.

This guide will walk you through the entire approval journey for 2025. I’ll cover qualification requirements, necessary documents, and how to navigate the mortgage landscape with confidence.

Key Takeaways

- A pre-approval is a crucial first step before you start looking at properties.

- It gives you a clear maximum budget for your home search.

- This process can lock in an interest rate for a specific period.

- It demonstrates to sellers that you are a serious and prepared buyer.

- Pre-approval is different from a final, unconditional mortgage commitment.

- Understanding the process helps you narrow your search efficiently.

- Being prepared with the right documents speeds up the application.

Understanding Mortgage Pre-Approval in Canada

To shop with confidence, you need a clear understanding of your borrowing power. This is where a formal assessment from a lender becomes invaluable. It transforms you from a casual looker into a prepared buyer.

What is Mortgage Pre-Approval?

Think of this step as a conditional commitment. A financial institution reviews your finances to determine the maximum loan amount you qualify for. They also specify an interest rate they will hold for you.

This process involves a detailed look at your income, assets, and existing debts. The lender will also check your credit history. This gives them a complete picture of your financial health.

It’s crucial to know this is not a final approval. It is a strong indication based on your current situation. The offered rate is typically guaranteed for 60 to 130 days. This protects you if market rates rise.

Benefits for Home Buyers

The advantages are significant. You gain a realistic budget, which prevents the heartache of falling for a home you cannot afford. This knowledge makes your search efficient and focused.

When you make an offer, sellers see you as a serious contender. Your position is stronger than buyers without this financial backing. Make sure you understand that the pre-approved maximum amount is a ceiling. It is often wise to look slightly below it for financial comfort.

This step streamlines the final mortgage application. You have already done much of the legwork. This can lead to a quicker closing process when you find the right property.

Steps to Qualify for a Mortgage

Your journey to securing a home loan hinges on two critical evaluations conducted by lenders. They need a complete picture of your financial health to determine the loan amount you can responsibly manage.

Assessing Income and Debts

Lenders start by verifying your gross income. This includes your salary, bonuses, and other reliable sources. They look for a steady history, typically two years.

Next, they tally all your monthly debt payment obligations. This includes car loans, credit cards, and student loans. Your total debt load is a key factor.

Determining Your Maximum Loan Amount

This is where debt service ratios come into play. The Gross Debt Service (GDS) ratio measures your housing costs. These should generally not exceed 32-39% of your gross income.

The Total Debt Service (TDS) ratio includes housing costs plus all other debts. This total should typically stay below 40-44% of your income.

For example, if your gross monthly income is $6,000, your ideal total monthly mortgage payments and other debts should be under $2,640. You can use an online calculator to estimate your numbers.

Understanding these ratios helps you see what you might qualify for a mortgage before you even apply. It empowers you to shop within a realistic budget.

The Pre-Approval Process: From Application to Approval

The journey from initial inquiry to receiving your financial confirmation involves several key stages. I’ll guide you through each phase so you know exactly what to expect.

Overview of Pre-Approval Steps

Your first decision involves choosing your application path. You can work directly with a financial institution or use a mortgage broker. Both options have distinct advantages.

Next, gather all necessary documentation. This includes income verification, employment details, and asset information. Having everything ready speeds up the entire procedure.

Modern platforms have revolutionized this experience. Services like Scotiabank’s eHOME can reduce approval time from weeks to minutes. You receive your confirmation letter with exclusive online rates quickly.

The lender thoroughly reviews your submission. They verify employment, analyze income sources, and check credit history. This comprehensive assessment determines your borrowing capacity.

Once approved, you receive specific details about your loan offer. This includes the maximum amount and locked-in rate. The rate protection typically lasts 60 to 130 days.

This preparation is especially valuable for newcomers navigating the Canadian housing market. It provides clarity and confidence before you start property shopping.

Essential Documents Checklist for Mortgage Pre-Approval

The key to a smooth application experience lies in thorough preparation of your financial documents. Having everything organized before you start saves valuable time and demonstrates your seriousness to potential lenders.

I recommend gathering these materials in advance to avoid delays. This preparation shows you’re ready to move quickly when you find the right property.

Identification and Proof of Employment

Lenders need government-issued photo identification to verify your identity. This helps prevent fraud and ensures security throughout the process.

For employment verification, you’ll need recent pay stubs and a letter from your employer. Self-employed individuals should prepare tax documents from the past two years. These details help establish your income stability.

Financial Statements and Debt Information

You must provide proof of your down payment funds and asset information. Recent bank statements and investment account summaries give lenders a clear financial picture.

Be prepared to share complete debt information including credit cards, loans, and other obligations. Accurate financial details help determine your comfortable payment range for your future home.

Improving Your Credit and Debt Service Ratios

Before lenders consider your loan application, they scrutinize your financial track record through a numerical lens known as your credit score. This three-digit number represents your creditworthiness and directly influences the interest rates you’ll receive.

Understanding Credit Impact and Hard Inquiries

When you apply for financing, institutions perform a hard credit check. This inquiry creates a notation on your record and may temporarily affect your score. The impact typically lasts up to 36 months.

The good news is that multiple inquiries from different lenders within a short period count as one single inquiry. You have between 14 to 45 days to shop for the best rates without additional credit damage.

Lenders evaluate both your ability to pay (income versus debts) and your willingness to pay (credit history). If you have limited credit history, they may review alternative payment records like utility bills or rent.

| Credit Score Range | Impact on Qualification | Typical Interest Rate Impact |

|---|---|---|

| 800-900 (Excellent) | Easiest qualification | Best available rates |

| 680-799 (Good) | Strong approval chances | Competitive rates |

| 600-679 (Fair) | May require additional documentation | Higher rates possible |

| Below 600 (Poor) | Challenging qualification | Significantly higher rates |

Review your credit report before applying to identify any errors. Correcting mistakes can improve your score and help you secure better terms. Paying down existing debts also lowers your total debt service ratio, making you a stronger candidate.

Choosing the Right Lender or Mortgage Broker in Canada

Your choice between working with a direct lender or a mortgage broker will shape your entire borrowing experience. Each path offers distinct advantages depending on your financial situation and preferences.

Comparing Lender and Broker Options

Direct lenders include banks, credit unions, and specialized loan companies. They provide financing directly to you. Different institutions offer varying interest rates and conditions.

Working with multiple lenders helps you find the best mortgage terms. A broker acts as an intermediary who shops your application across their network. This can access specialized mortgages not available through traditional channels.

Not all mortgage brokers work with the same financial institutions. Always ask which lenders they partner with before committing.

Clarifying Fees and Commissions

Most mortgage brokers receive commissions from the lender rather than charging you directly. This means their service typically comes at no direct cost to borrowers.

Provincial regulators oversee broker licensing. Verify credentials before proceeding. Comparing both options ensures you secure the optimal loan for your needs.

Common Pitfalls in the Mortgage Pre-Approval Process

Even with a conditional commitment in hand, several critical factors can still derail your home purchase. Understanding these potential obstacles helps you navigate the final stages more effectively.

Avoiding Application Errors

One significant mistake involves providing incomplete or inaccurate information. When your lender verifies your details, discrepancies can cause delays or outright rejection.

Maintaining financial stability during this period is crucial. Changing jobs, taking on new debt, or making large purchases can jeopardize your status. Your financial profile must remain consistent from application to closing.

Managing Expectations with Lender Requirements

Many buyers mistakenly believe pre-approval guarantees final loan acceptance. However, your chosen property must also meet the institution’s standards. These criteria vary between financial institutions.

The pre-approved amount represents your maximum potential borrowing capacity. Your final mortgage depends on the home‘s appraised value and your down payment. For example, if a property is priced above what the lender will finance, you may need a larger down payment.

If you face challenges, ask about alternatives. Options might include a lower mortgage amount, higher interest rate, or requiring a co-signer. Understanding these possibilities prepares you for various outcomes.

mortgage pre-approval Canada: Navigating Credit, Rates, and Terms

Securing favorable financing terms requires understanding how credit, rates, and timing interact. Your financial profile directly influences the offers you receive from financial institutions.

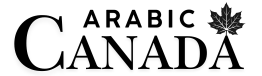

Locking in the Best Interest Rate

One significant advantage of this financial step is the rate protection feature. Most institutions guarantee your offered interest rate for 60 to 130 days.

This protection works in your favor regardless of market movements. If rates increase, your locked-in rate remains safe. Should interest rates decrease, you can typically secure the lower rate instead.

I recommend asking specific questions when you get pre-approved. Inquire about the guarantee period and whether you automatically qualify for better rates if they drop. This is particularly helpful for newcomers learning the system.

Different lenders offer varying conditions for similar products. Shopping around ensures you find the most competitive terms. The process of comparing offers during a short window minimizes credit impact while maximizing your options.

Conclusion

Taking control of your financial readiness is the ultimate goal of this entire preparation. This initial step provides a powerful edge, giving you a clear budget and demonstrating your seriousness to sellers.

Remember, this is a conditional commitment based on a thorough review of your finances. Having your documents organized and understanding your debt ratios streamlines the process significantly.

Your final loan approval depends on the property and your stable financial profile. Use online tools like a calculator to estimate your comfortable monthly payment.

Armed with this knowledge, you can confidently approach lenders and secure the financing for your dream home.