قراءة نهاية الأسبوع: اكتشف أسرار الشركات الكندية الناجحة!

It looks like you’ve shared a detailed post about investing insights, particularly focusing on Canadian compounders and the wisdom of Warren Buffett. Here’s a summary of the key points from your post:

- Investment Behavior: Emphasizing that emotions play a significant role in investment decisions, it’s crucial for investors to understand their own behaviors and motivations.

- Long-term Savings: Highlighting that keeping money in cash or bonds can lead to wasted savings due to inflation and taxes, suggesting that investors should seek better long-term growth options.

- Cost Efficiency: Stressing the importance of minimizing fees as they directly impact overall wealth accumulation.

- Marketing Influence: Quoting Mark Twain on how effective advertising can significantly enhance the perception and success of products or services.

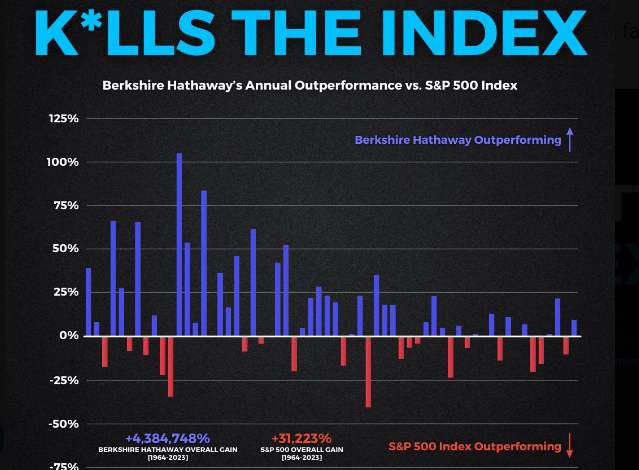

- Warren Buffett’s Success: Celebrating Buffett’s recent achievement with Berkshire Hathaway reaching a $1 trillion market cap, showcasing his impressive long-term performance compared to the S&P 500.

- Canadian Compounders Podcast: Mentioning insights from a podcast discussing top Canadian stocks known for consistent growth (compounders), encouraging listeners to explore these investment opportunities further.

- Community Engagement: Encouraging readers to share their own investment experiences and strategies while highlighting successful individuals in the financial independence community.

- Resources for Investors: Providing links to additional resources such as personal finance books, stock recommendations, and lessons learned from seasoned investors like Warren Buffett.

your post serves as an informative guide for both novice and experienced investors looking to refine their strategies while learning from established principles in investing.It looks like you’ve shared a detailed blog post or article about investing, particularly focusing on stocks with competitive advantages (moats), dividend growth, and insights from notable investors like Warren Buffett. Here’s a summary of the key points:

- Stocks with Moats: The article emphasizes the importance of investing in companies that have a strong competitive advantage, often referred to as having ”moats.” This concept is crucial for long-term investment success.

- Dividend Growth: Mike @TheDividendGuy shares his list of 10 amazing dividend growers, highlighting the significance of dividends in building wealth over time.

- Investment Behavior: A quote from “The Single Best Investment” discusses how emotions can influence investment decisions and stresses the need for self-awareness in investing.

- Long-Term Savings Strategy: The piece mentions that keeping money in cash or bonds may not be effective due to inflation and taxes, advocating for more productive investments.

- Warren Buffett’s Success: It highlights Berkshire Hathaway’s impressive market performance and Buffett’s long-term returns compared to the S&P 500, showcasing his investment philosophy and strategies.

- Avoiding Mistakes: There are references to common pitfalls in investing and suggestions on which ETFs might be avoided based on expert opinions.

- Financial Independence Journey: Joe at Retire by 40 is recognized for tracking his financial progress effectively as part of achieving financial independence.

- Community Insights: Dividend Daddy’s strategy involves accumulating dividend income through strategic purchases, demonstrating successful portfolio management leading to significant annual income.

- Encouragement for Readers: The post concludes with an encouraging message about saving, investing wisely, and enjoying life while pursuing financial goals.

If you have specific questions or need further information about any section mentioned above or related topics, feel free to ask!