قراءة نهاية الأسبوع: أفضل 100 سهم يوزع أرباحاً لتحقيق دخل ثابت!

It seems like you’re sharing a detailed overview of investment strategies, particularly focusing on dividend stocks and the “TULF” framework for Canadian investments. Here’s a summary of the key points:

- Investment Focus: The article emphasizes sectors such as Real Estate Investment Trusts (REITs), Utilities, Telecoms, and Financials due to their stability in business and earnings.

- TULF Stocks:

– T: Telecommunications (e.g., Telus)

– U: Utilities (e.g., Fortis, Emera)

– L: Low-yielding dividend growth stocks with potential (e.g., Canadian National Railway)

– F: Financials (including big-6 banks and EQB for growth)

- Performance of U.S. Stocks: The author notes significant gains in select U.S. stocks like Walmart (+44%), Southern Company (+25%), and Waste Management (+14%) year-to-date.

- ETF Performance: The low-cost ETF XAW is highlighted as performing well with a 13% increase YTD despite recent market declines.

- Market Trends: There’s an indication that declining interest rates may lead investors back to high-dividend-paying Canadian stocks due to their tax advantages over interest income.

- Personal Finance Content Recommendations: A mention of an interview from “The Wealthy Barber” podcast is included as valuable content for personal finance enthusiasts.

- Golf Drill Mentioned: The author shares a personal note about working on golf skills, indicating a balance between investing advice and personal interests.

- Services Offered by Author’s Platform:

– Low-cost financial projections services.

– Options for DIY investors including done-for-you services or software access for self-managed financial planning.

This summary encapsulates the main themes discussed in your text regarding investment strategies focused on dividends while also touching upon personal insights from the author’s life outside investing.It looks like you’ve shared a detailed blog post about investing in dividend stocks, particularly focusing on Canadian stocks and some insights into U.S. stocks as well. The article discusses the importance of dividend-paying stocks for income and growth, especially in light of changing interest rates.

Here are some key takeaways from the content:

- Top 100 Dividend Stocks: The post references a list of top Canadian dividend stocks for 2024, emphasizing that this list is a starting point for investors looking to build their portfolios.

- Interest Rates Impact: With interest rates declining, analysts believe that high-dividend-paying Canadian stocks will become more attractive to investors due to their tax advantages over interest income and potential for long-term growth.

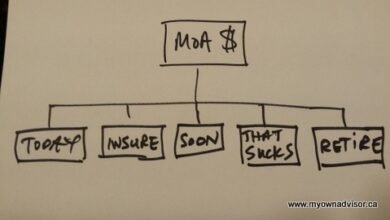

- TULF Strategy: The author mentions a strategy involving “TULF” (Telecommunications, Utilities, Low-yielding growth stocks, Financials) as categories of investments that can provide both income and stability.

- U.S. Stock Performance: The author shares personal experiences with U.S. stock performance in 2023, highlighting significant gains from companies like Walmart and Waste Management.

- Golf Drill Mentioned: In addition to financial topics, there’s a personal touch with the author discussing golf drills they are working on—showcasing an interest outside of investing.

- Services Offered: The post promotes low-cost financial projection services aimed at DIY investors who want assistance without high fees or conflicts of interest.

- Engagement with Readers: There’s an invitation for readers to engage by sharing their own experiences or questions regarding personal finance or investing strategies.

If you have any specific questions about this content or need further information on any particular aspect mentioned in the article, feel free to ask!