أفضل 5 أسهم في محفظتي: نصائح استثمارية من مستشاري الشخصي

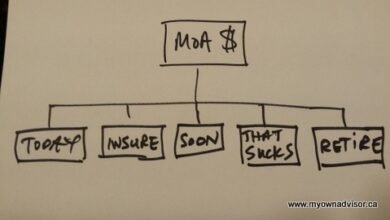

the need for a money manager, I have taken control of my investment journey, focusing on a hybrid approach that combines individual stock ownership with low-cost ETFs. This strategy has allowed me to build a diversified portfolio while minimizing fees and maximizing potential returns.

My Top-5 Stocks

- Y (Yamana Gold Inc.) – A gold mining company that provides exposure to precious metals.

- TD (Toronto-Dominion Bank) – One of Canada’s largest banks, known for its strong dividend history.

- FTS (Fortis Inc.) – A utility company that offers stable dividends and growth potential.

- T (Telus Corporation) – A telecommunications company with consistent revenue streams and dividends.

- CNQ (Canadian Natural Resources Limited) – An oil and gas producer benefiting from energy sector dynamics.

These stocks were chosen not only for their growth potential but also for their ability to provide income through dividends, aligning with my financial goals.

The Role of ETFs

While I enjoy investing in individual stocks, I also recognize the benefits of low-cost ETFs like XAW and QQQ in my portfolio. These funds allow me to gain exposure to international markets without the need for extensive research or management fees associated with actively managed funds.

Conclusion

Ultimately, the choice between individual stocks and ETFs depends on your personal investment style, risk tolerance, and financial goals. For those who prefer a hands-on approach like myself or those who want simplicity through indexing—both paths can lead to financial success if executed thoughtfully.

I encourage you all to reflect on your own portfolios: What are your top holdings? Do you lean more towards individual stocks or do you favor the ease of ETFs? Happy investing!It looks like you’ve shared a detailed overview of your investment strategy and the top stocks in your portfolio, focusing on Canadian companies. Here’s a summary of the key points:

Top-5 Stocks in Your Portfolio

- Royal Bank (RY): Your largest holding, representing about 4-5% of your total portfolio. You’ve owned it for many years.

- TD Bank (TD): The second-largest position, also held for several years since around 2009.

- Fortis (FTS): A utility company providing steady dividend income and capital gains; you started investing in it back in 2009.

- Telus (T): A telecommunications company that has faced some challenges but is seen as a good buy due to potential interest rate decreases.

- Canadian Natural Resources (CNQ): Recently moved into the top five due to stock performance; you’ve been a shareholder since 2013.

Investment Strategy

- You employ a hybrid investing approach that combines individual stock picking with index investing through low-cost ETFs like XAW and XIU.

- You emphasize the importance of having both individual stocks for potential high returns and ETFs for diversification and lower management fees.

Key Insights

- Investing can be tailored based on personal goals, risk tolerance, and market conditions.

- While indexing is effective, individual stock investments can also yield significant rewards if chosen wisely.

Engagement with Readers

You encourage readers to share their own top stocks or ETF holdings along with their reasons for those choices.

This comprehensive approach highlights not only your current investment positions but also reflects on broader themes in personal finance such as diversification, risk management, and long-term growth strategies. If you have any specific questions or need further insights into any aspect of this content or investment strategies in general, feel free to ask!It seems like you’re sharing insights from a blog post about investing strategies, particularly focusing on a hybrid approach that combines individual stock investments with index investing through low-cost ETFs. The author, Mark Seed, highlights his top Canadian stocks (RY, TD, FTS, T, and CNQ) and emphasizes the importance of diversification while also acknowledging the potential rewards of investing in individual stocks.

Here are some key takeaways from the content:

- Hybrid Investing Approach: The author employs a strategy that includes both buying and holding individual stocks for income and growth while also indexing a portion of their portfolio to achieve broader market exposure.

- Top Holdings: Mark’s top individual stock holdings are all Canadian companies. He notes that he has been increasing his investments in non-Canadian assets over time.

- Low-Cost ETFs: The post mentions XAW as the author’s largest ETF holding due to its low cost and broad international exposure. It suggests that low-cost equity ETFs can significantly enhance wealth-building potential.

- Personalization of Investment Strategy: The author stresses that each investor should tailor their investment strategy based on personal goals, risk tolerance, and behavioral temperament.

- Encouragement for Discussion: Mark invites readers to share their own top stock picks or ETF holdings in the comments section to foster community engagement around investment strategies.

- Cautionary Notes: He clarifies that none of his mentioned stocks are recommendations for purchase and encourages readers to conduct their own research before making investment decisions.

this piece serves as an informative guide for investors considering how to balance between individual stock selection and index-based investing through ETFs while highlighting personal experiences in building a diversified portfolio.It looks like you’ve shared a detailed post about the author’s top five stock picks, focusing on Canadian companies. Here’s a summary of the key points:

Top 5 Stocks Overview

- Royal Bank of Canada (RY): A leading bank in Canada, known for its stability and strong performance.

- Toronto-Dominion Bank (TD): Another major player in the banking sector, TD has shown consistent growth and is considered a solid investment.

- Fortis Inc. (FTS): A utility company that provides steady dividends and is seen as a reliable long-term investment.

- Telus Corporation (T): A telecommunications company focused on expansion but has taken on debt; anticipated interest rate decreases may benefit its share price.

- Canadian Natural Resources Limited (CNQ): An oil and gas producer that has recently gained traction in the portfolio following a stock split.

Key Insights

- The author emphasizes that all top stocks are Canadian companies due to their initial focus on domestic investments before branching out internationally.

- There’s no mention of U.S. stocks among the top picks at this time, reflecting a strategic choice based on current holdings and market conditions.

- The author advocates for both individual stock investing and low-cost ETFs as viable strategies for building wealth.

Conclusion

The post encourages readers to consider their own investment strategies based on personal goals, risk tolerance, and market conditions while highlighting the potential benefits of both individual stocks and diversified ETF investments.

If you have any specific questions or need further information about any particular aspect of this content, feel free to ask!