أفضل صناديق الاستثمار المتداولة الكندية ذات العوائد – دليلك الشامل لتحقيق الأرباح!

It seems like you’re sharing a detailed perspective on why you don’t own any Canadian dividend ETFs, along with insights into your investment philosophy. Here’s a summary of the key points you’ve made:

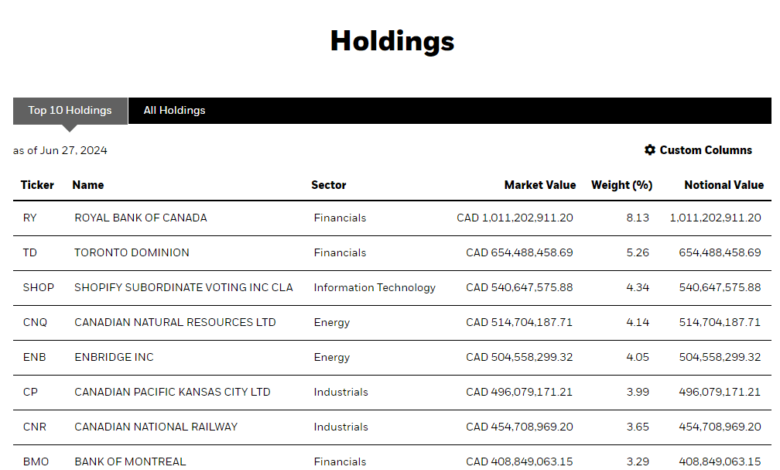

- Personal Ownership of Top Stocks: You already own the top holdings of popular Canadian dividend ETFs like Vanguard’s VDY and BMO’s ZDV, which makes investing in these ETFs redundant for you.

- Sector Concentration Risk: You express concern about sector concentration risk, particularly with VDY being heavily weighted in Canadian banks. By owning individual stocks, you can diversify more effectively across different sectors.

- Cost Efficiency: You prefer to avoid management fees associated with ETFs since you already hold many of their top stocks directly.

- Investment Strategy: Your strategy involves unbundling what an ETF offers to create a portfolio that aligns more closely with your goals for income and growth without incurring additional costs.

- Preference for XIU: If you were to choose one ETF for Canadian content, it would be XIU due to its steady yield and long-term growth potential.

- DIY Investing Principles:

– Keep fees low.

– Diversify across various sectors beyond just financials and energy.

– Be tax-efficient by considering how dividends are taxed in taxable accounts.

- Considerations When Choosing ETFs:

– Style (index tracking vs sector-specific).

- Fees (management expense ratios).

– Tracking error (performance relative to benchmarks).

– Diversification within the ETF.

– Tax efficiency based on account type (registered vs taxable).

- Long-Term Perspective on Equities vs Bonds: You advocate for holding equities over bonds for long-term wealth building while acknowledging that diversification is crucial even when investing through ETFs or individual stocks.

Your approach emphasizes a hands-on strategy where direct ownership of stocks allows greater control over investments while minimizing costs associated with managed funds or ETFs that may not align perfectly with your investment goals or preferences.

If readers are interested in exploring specific Canadian dividend ETFs or want advice tailored to their unique situations, they might consider factors such as their investment horizon, risk tolerance, and whether they prioritize income generation versus capital appreciation when making decisions about their portfolios.It seems like you’ve shared a detailed article discussing the reasons for not owning Canadian dividend ETFs, along with some insights into specific ETFs and investment strategies. Here’s a summary of the key points:

Reasons for Not Owning Canadian Dividend ETFs

- Direct Ownership of Stocks: The author owns all top-10 stocks in the Vanguard Canadian High Dividend Yield Index ETF (VDY) individually, which eliminates the need to invest in the ETF itself.

- Sector Concentration Risk: VDY has significant exposure to Canadian banks, leading to sector concentration risk that can be mitigated by selecting individual stocks.

- Cost Efficiency: By owning individual stocks that are also top holdings in BMO Canadian Dividend ETF (ZDV), the author avoids paying management fees associated with ETFs.

- Investment Strategy Shift: The author has rotated out of certain sectors like REITs, which are included in iShares Core S&P/TSX Composite High Dividend Index ETF (XEI), thus opting not to invest in this ETF.

- Preference for XIU: If forced to choose one Canadian content ETF, it would be XIU due to its steady yield and long-term growth potential; however, they prefer unbundling this strategy instead of holding an ETF.

Investment Principles Suggested

- Keep fees low across all accounts.

- Diversify holdings beyond financials and energy sectors.

- Focus on tax efficiency by considering lower-yielding but higher-growth stocks within taxable accounts.

Summary of Top Canadian Dividend ETFs

The article lists several notable dividend ETFs along with their management expense ratios (MER), number of holdings, and total returns over 5 and 10 years:

| ETF Symbol | MER | # of Holdings | Total 5-Year Return | Total 10-Year Return |

|—————-|———|——————-|————————–|—————————|

| VDY | 0.22% | 56 | 61% | 100% |

| ZDV | 0.39% | 51 | 46% | 67% |

| XEI | 0.22% | 75 | 50% | 70% |

| XIU | 0.18% | 60 | 55% |103 % |

The author emphasizes that while there are many options available for investing in dividend-paying companies through ETFs or direct stock ownership, personal investment strategies should align with individual goals and preferences regarding fees, diversification, and tax implications.

If you have any specific questions or need further information about any aspect mentioned above or related topics on investing strategies or particular funds/ETFs, feel free to ask!It looks like you’ve shared a detailed article about Canadian dividend ETFs from “My Own Advisor.” The article discusses various ETFs, their performance, and the author’s personal investment philosophy. Here’s a summary of the key points:

Top Canadian Dividend ETFs

- VDY (Vanguard Canadian High Dividend Yield Index ETF)

– MER: 0.22%

– Number of Holdings: 56

- Total 5-Year Return: 61%

– Total 10-Year Return: 100%

- ZDV (BMO Canadian Dividend ETF)

– MER: 0.39%

– Number of Holdings: 51

– Total 5-Year Return: 46%

– Total 10-Year Return: 67%

- XEI (iShares Core S&P/TSX Composite High Dividend Index ETF)

– MER: 0.22%

- Number of Holdings: 75

– Total 5-Year Return: 50%

– Total 10-Year Return:70%

- XIU (iShares S&P/TSX Capped Composite Index ETF)

– MER:0.18%

– Number of Holdings :60

–Total Five Year return :55%

–Total Ten Year return :103%

- Comparison Only:

XAW (iShares Core MSCI All Country World ex Canada Index ETF)

MER :0 .20 %

#of holdings :8,700+ stocks

total five year return :71 %

* total ten year return:N/A

Author’s Perspective on Ownership

- The author does not own any top Canadian dividend ETFs because he holds many of the underlying stocks directly.

- He prefers to avoid sector concentration risks associated with certain sectors like financials and energy.

- If he had to choose one ETF for Canadian content, it would be XIU due to its steady yield and long-term growth potential.

Investment Principles Suggested by the Author:

- Keep fees low across all accounts.

- Diversify by owning blue-chip companies across various sectors.

- Be tax-efficient by considering where you hold different types of investments.

The author emphasizes that while these ETFs can provide income and capital appreciation over time, individual investment strategies may vary based on personal circumstances.

If you have specific questions or need further information about any aspect mentioned in this article, feel free to ask!