قراءة نهاية الأسبوع: مقارنة مثيرة بين السندات وGICs!

It looks like you’ve shared a detailed blog post discussing the comparison between bonds and Guaranteed Investment Certificates (GICs) in the context of personal finance. The author, Mark Seed, explores various aspects of both investment options, highlighting their benefits and drawbacks.

Key Points from the Post:

- Bonds vs. GICs:

– Bonds: Typically accessible through bond ETFs, allowing investors to own a range of bond durations with relatively low management fees.

– GICs: Considered one of the safest investments as they guarantee principal and interest through banks or financial institutions, insured by the Canada Deposit Insurance Corporation (CDIC) up to $100,000.

- Advantages of GICs:

– They provide diversification away from equities.

- Offer certainty regarding access to funds without market volatility risks.

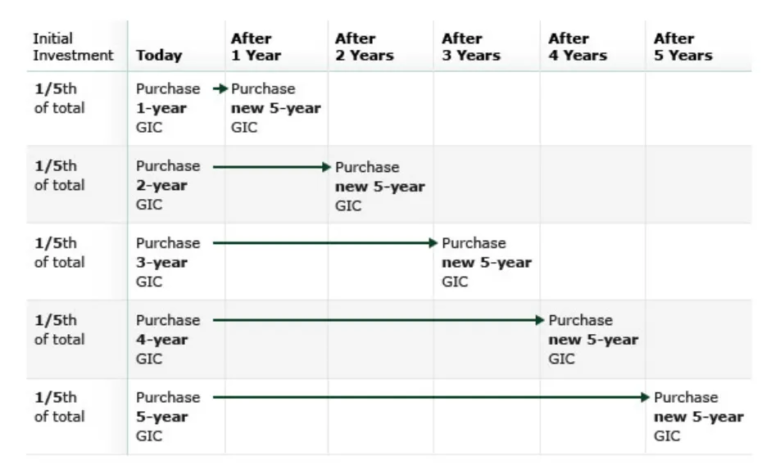

– Can be laddered for better cash flow management over time.

- Personal Preference:

– The author expresses a personal preference for avoiding bonds in his portfolio while acknowledging that others may find them beneficial for risk management.

- Real-Life Examples:

- The post includes anecdotes about individuals who have successfully navigated their investments and retirement planning by making informed decisions about their portfolios.

- Taxation Concerns:

– There is also mention of complexities within Canada’s tax system related to RRIF mandatory withdrawals and calls for simplification.

- Engagement with Readers:

- The author encourages readers to consider other debates in personal finance and shares insights into his own investment philosophy.

Conclusion

The discussion emphasizes that choosing between bonds and GICs depends on individual financial goals, risk tolerance, and investment strategy preferences. It invites readers to reflect on their own experiences with investing while providing valuable insights into managing finances effectively during retirement or pre-retirement stages.

If you have any specific questions or need further information on this topic or related subjects, feel free to ask!It looks like you’ve shared a detailed blog post or article discussing various personal finance topics, including the debate between bonds and GICs (Guaranteed Investment Certificates), investment strategies, tax issues in Canada, and some personal anecdotes about investing.

Here’s a brief summary of the key points:

- Bonds vs. GICs: The author suggests that for those prioritizing capital preservation and guaranteed interest, GICs may be preferable to bonds.

- Personal Finance Debates: The author humorously mentions other debates such as coffee vs. tea and burgers vs. pizza while emphasizing that personal finance choices are subjective.

- Investment Strategies: The piece references Henry Mah, an 80-something DIY investor who focuses on concentrated stocks for income generation.

- Retirement Planning: It discusses a retiree who changed his financial trajectory by saving diligently and diversifying investments to retire early.

- Tax System Complexity: There is criticism of the Canadian tax system’s complexity, particularly regarding mandatory RRIF withdrawals which can create unnecessary burdens for retirees.

- Success Stories in Investing: A couple turned a $150,000 investment into $2 million through strategic investments in smaller oil & gas companies post-pandemic.

- Engagement with Readers: The author encourages readers to reflect on their own big bets in investing or career choices while wishing them a great weekend.

If you have specific questions or need further analysis on any part of this content, feel free to ask!The article presents a comparison between bonds and Guaranteed Investment Certificates (GICs), highlighting the advantages of GICs for certain investors, particularly those focused on capital preservation and guaranteed returns. Here’s a summary of the key points:

Bonds vs. GICs

Bonds:

- Typically accessible through bond ETFs, allowing investors to own various durations.

- Subject to market volatility, which can lead to capital losses.

- Can help diversify portfolios and provide stability during stock market fluctuations.

GICs:

- Considered one of the safest investment options with guaranteed principal and interest.

- Insured by the Canada Deposit Insurance Corporation (CDIC) up to $100,000.

- Offer different types such as non-redeemable, cashable, and market-linked GICs.

Advantages of GICs Over Bonds:

- Diversification from Equities: GICs are generally not correlated with stock market performance, providing a buffer against equity volatility.

- Certainty of Access: Ideal for retirees or those nearing retirement; they offer less volatility compared to bonds and can be laddered for better liquidity.

Personal Preference:

The author expresses a personal preference for avoiding bonds in favor of holding GICs due to their safety and predictability in returns. They emphasize that while some may find value in including bonds for portfolio balance or psychological comfort during downturns, their strategy leans towards maximizing capital preservation through cash equivalents like GICs.

Conclusion:

Ultimately, whether an investor should choose bonds or GICs depends on individual financial goals, risk tolerance, and investment horizon. The discussion reflects broader themes in personal finance where choices are often subjective—what works best varies from person to person.

If you have any specific questions about this topic or need further details on any aspect mentioned above, feel free to ask!